고혈압은 현대 사회에서 매우 흔한 건강 문제 중 하나입니다. 하지만 그 위험성은 자주 간과되곤 합니다. 고혈압은 장기적으로 심혈관 질환, 뇌졸중, 심장마비와 같은 심각한 건강 문제를 초래할 수 있기 때문에, 그 원인과 증상을 잘 이해하고 적절한 치료와 예방을 통해 관리하는 것이 중요합니다. 주변에서 심심치 않게 고혈압 환자들을 많이 볼 수 있을텐데요. 이번 글에서는 고혈압의 원인, 증상, 예방 방법, 그리고 치료 옵션까지 전반적으로 살펴보겠습니다.

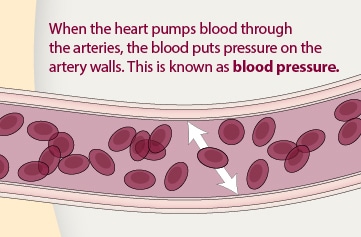

1. 고혈압이란 무엇인가?

고혈압은 혈액이 동맥 벽에 가하는 압력이 지속적으로 높아지는 상태를 말합니다. 이는 심장과 혈관에 큰 부담을 주어 장기적으로 건강에 심각한 영향을 미칠 수 있습니다. 정상적인 혈압은 보통 120/80 mmHg 이하로 유지됩니다. 여기서 120은 수축기 혈압으로, 심장이 혈액을 동맥으로 내보낼 때의 압력을 의미하며, 80은 이완기 혈압으로, 심장이 이완할 때의 압력을 의미합니다.

1.1 고혈압의 단계

고혈압은 일반적으로 두 가지 단계로 나눌 수 있습니다:

- 1단계 고혈압: 수축기 혈압이 130

139 mmHg 또는 이완기 혈압이 8089 mmHg인 경우입니다. - 2단계 고혈압: 수축기 혈압이 140 mmHg 이상 또는 이완기 혈압이 90 mmHg 이상인 경우입니다.

이러한 단계는 고혈압의 심각도를 나타내며, 2단계 고혈압은 건강에 더욱 큰 위험을 초래할 수 있습니다. 특히, 고혈압은 심장, 뇌, 신장, 눈 등 여러 장기에 장기적인 손상을 초래할 수 있으며, 이를 통해 심각한 질병으로 이어질 수 있습니다.

1.2 고혈압의 위험성

고혈압은 초기에는 특별한 증상이 나타나지 않기 때문에, 이를 “침묵의 살인자”라고 부르기도 합니다. 하지만, 고혈압이 장기적으로 지속될 경우 심장병, 뇌졸중, 신부전, 시력 상실 등의 위험이 크게 증가합니다. 특히, 고혈압은 동맥 경화를 가속화시켜 혈관이 좁아지고 탄력을 잃게 만듭니다. 이러한 상태는 심장에 더 많은 부담을 주어, 궁극적으로 심부전과 같은 심각한 심장 질환을 유발할 수 있습니다.

1.3 고혈압의 종류

고혈압은 크게 원발성 고혈압과 이차성 고혈압으로 나뉩니다.

- 원발성(본태성) 고혈압: 대부분의 고혈압 환자가 해당되며, 특별한 원인 없이 발생합니다. 유전적 요인, 생활 습관, 나이 등이 주요 위험 요인으로 작용합니다.

- 이차성 고혈압: 신장 질환, 호르몬 이상, 특정 약물의 사용 등 특정 원인에 의해 발생하는 고혈압입니다. 이차성 고혈압은 원인을 제거하면 혈압이 정상으로 돌아올 수 있습니다.

고혈압을 효과적으로 관리하기 위해서는 자신의 혈압 상태를 정기적으로 체크하고, 필요시 전문가의 도움을 받아야 합니다. 특히, 고혈압의 원인을 정확히 파악하여 적절한 예방 및 치료 전략을 세우는 것이 중요합니다.

1.4 고혈압 관리의 중요성

고혈압은 일상적인 건강 관리와 적절한 치료를 통해 충분히 관리할 수 있는 질환입니다. 정기적인 혈압 측정과 함께 건강한 식습관, 규칙적인 운동, 스트레스 관리, 금연, 절주 등의 생활 습관을 통해 고혈압을 예방하고 조절할 수 있습니다. 고혈압 관리를 소홀히 하면 만성 질환으로 발전할 수 있으므로, 초기 단계에서부터 적극적으로 대처하는 것이 중요합니다.

고혈압은 많은 성인들이 겪고 있는 흔한 문제이지만, 그 위험성을 인식하고 조기에 관리하는 것이 건강한 삶을 유지하는 데 필수적입니다. 고혈압이 어떻게 발생하는지, 그리고 어떻게 예방하고 관리할 수 있는지에 대한 더 많은 정보는 고혈압 완벽 가이드: 원인부터 치료까지에서 확인하실 수 있습니다.

2. 고혈압의 주요 원인

고혈압은 여러 가지 원인에 의해 발생할 수 있으며, 다음과 같은 요인들이 고혈압을 유발하거나 악화시킬 수 있습니다:

- 유전적 요인: 가족 중 고혈압 환자가 있는 경우, 고혈압에 걸릴 확률이 높아집니다.

- 생활 습관: 과도한 소금 섭취, 음주, 흡연, 운동 부족 등은 고혈압을 유발할 수 있습니다. 이러한 생활 습관은 혈압을 높이는 주요 원인으로 작용합니다.

- 스트레스: 만성적인 스트레스는 혈압을 상승시킬 수 있습니다. 스트레스 관리가 중요한 이유입니다. 스트레스와 고혈압의 관계: 어떻게 관리할까?에서 더 자세한 정보를 확인하세요.

3. 고혈압의 증상

고혈압은 대부분 특별한 증상이 없기 때문에 “침묵의 살인자”라고 불리기도 합니다. 그러나 일부 사람들은 다음과 같은 증상을 경험할 수 있습니다:

- 두통

- 어지럼증

- 가슴 통증

- 호흡 곤란

이러한 증상이 나타날 경우, 즉시 의사를 찾아가야 합니다. 자세한 증상과 그 의미에 대해서는 고혈압 증상, 절대 놓치지 말아야 할 신호들에서 더 알아볼 수 있습니다.

4. 고혈압의 예방 방법

고혈압을 예방하기 위해서는 건강한 생활 습관을 유지하는 것이 가장 중요합니다. 다음은 고혈압 예방을 위한 몇 가지 생활 습관입니다:

- 규칙적인 운동: 운동은 혈압을 낮추고 심혈관 건강을 향상시키는 데 도움이 됩니다.

- 저염식 식단: 과도한 소금 섭취는 혈압을 높일 수 있습니다. 저염식을 실천하는 것이 중요합니다. 고혈압 환자를 위한 저염식 레시피 모음을 참고하세요.

- 균형 잡힌 식단: 고혈압에 좋은 음식을 섭취하면 예방에 도움이 됩니다. 고혈압에 좋은 음식 10가지: 건강한 식단 추천에서 추천 음식을 확인하세요.

5. 고혈압의 치료 방법

고혈압은 생활 습관 개선과 약물 치료를 통해 관리할 수 있습니다.

- 약물 치료: 고혈압이 심각한 경우 의사의 처방에 따라 약물 치료가 필요할 수 있습니다. 약물 치료의 장단점에 대해서는 고혈압 약물 치료의 모든 것: 장단점 분석에서 자세히 알아보세요.

- 생활 습관 개선: 규칙적인 운동, 건강한 식단, 스트레스 관리 등을 통해 혈압을 낮출 수 있습니다. 자연스러운 방법으로 혈압을 낮추는 방법에 대해 궁금하다면 고혈압을 자연스럽게 낮추는 5가지 운동 방법을 참고하세요.

결론

고혈압은 심각한 건강 문제를 초래할 수 있으므로, 그 원인과 증상을 잘 이해하고 예방과 치료를 통해 철저히 관리하는 것이 중요합니다. 규칙적인 혈압 체크와 건강한 생활 습관을 통해 고혈압을 예방하고 관리하세요. 고혈압에 대한 더 많은 정보와 유용한 팁은 고혈압 완벽 가이드: 원인부터 치료까지에서 확인할 수 있습니다. 건강한 삶을 위해 지금 바로 시작해보세요!